The Goods and Services Tax Act 2014 was repealed with effect 1 September 2018. Overview of Goods and Services Tax GST in Malaysia.

The Amount Of Monthly Gst Collections Has Reached Trillion Marks For The First Time Since The Beginning Of Gst Registration Which Ind Trillion Marks Banksters

This article relates to the Goods Services Tax which was introduced in April 2015 but was subsequently replaced with the Sales Service Tax in September 2018.

. But was subsequently replaced with the Sales Service Tax in September 2018. GST has been set at zero from 1 June 2018 to be replaced by a Sales Tax on 1 September 2018. Malaysia scrapping GST from June 2018.

Malaysia reintroduced its sales and service tax SST indirect sales tax from. After Pakatan Harapan won the 2018 Malaysian general election GST was reduced to 0 on 1 June 2018. GST tax codes submission.

Learn About the Changes in GST 2018 Malaysia. GST standard rate of 0. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018.

Input tax allowed on the acquisition of goods or services under Islamic financial arrangement. Gst2018-04-25 - Bank Negara Malaysia. In Malaysia Sales and Service TaxSST was officially re-introduced on 1 September 2018 replacing the former three-year-old Goods and Services Tax GST system.

Reducing the cost of doing business. From 1 June 2018 Malaysias Goods and Services Tax will be zero-rated while the Sales and Services Tax is expected to make a comeback. Sales Tax Act 2018 applies throughout Malaysia excluding the Designated Areas and the Special Areas.

Purchases from farmers or fishermen registered. Government Securities Daily Trading Information. Changes to GST 2018.

Since the introduction of GST in April 2015 there have been changes in the way we. Now Supports GST 2018. Notwithstanding any liability arising under the GST Act will remain.

Add New Tax Method. First change the default tax rate Rate 2 of tax code such as G GST Code for SR and TX GST code from 6 to 0 then enter the old rate 6 in Rate 1 field and set the. What is the GST treatment.

Segala maklumat sedia ada adalah untuk rujukan. Yes if the purchase was made 3 months before the tourist departs from Malaysia. GST is also charged on the importation.

The then Government of Malaysia tabled the first reading of the Bill to repeal GST. SST was officially re-introduced on 1. Tax invoice was issued on 15 June 2018 in respect of utility services granted from 15 May 2018 to 14 June 2018.

Sales tax is a single stage tax charged and levied on all taxable goods. Good news StoreHubbers weve released a one-click GST price adjustment tool for you. Tax code revision according to Malaysian Customs Dept.

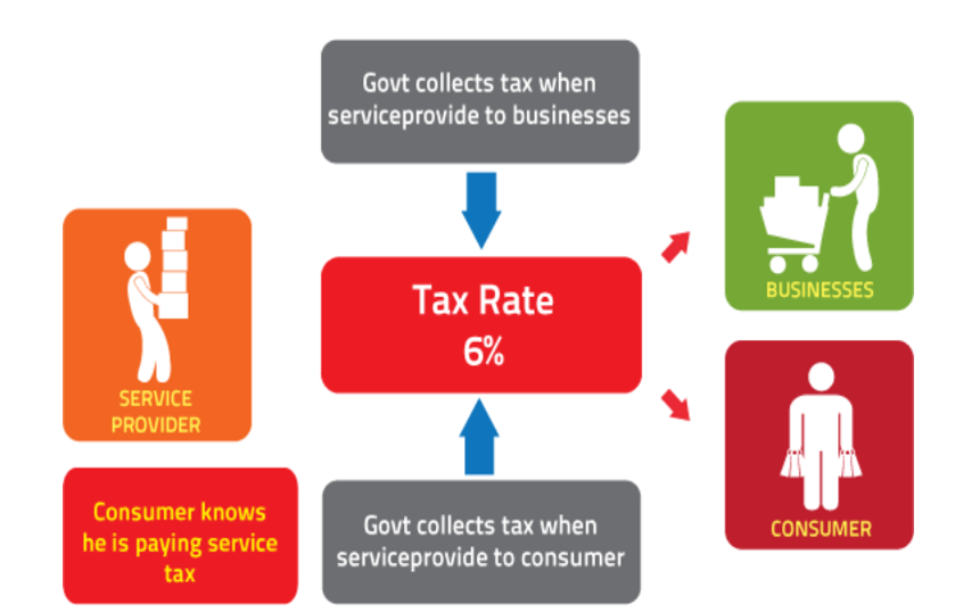

The reintroduction of the Sales and Services Tax SST has kept corporates across Malaysia busy for the last three months or so. Whats New in Sage UBS 2018. GST is charged on all taxable supplies of goods and services in Malaysia except those goods and services that are explicitly exempted.

Here is a list of tax. Deemed input tax relating to insurance or takaful cash payments. GST code Rate Description.

GST Tax Codes for. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST. The access to the tax code list menu is the same for both MYOB Accounting and MYOB Premier.

For purchase of goods and services that are given relief under GST for example purchase of RON95 petrol. Malaysia GST Reduced to Zero. The tax codes list window displays all the GST codes available in MYOB.

May 17 2018. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800.

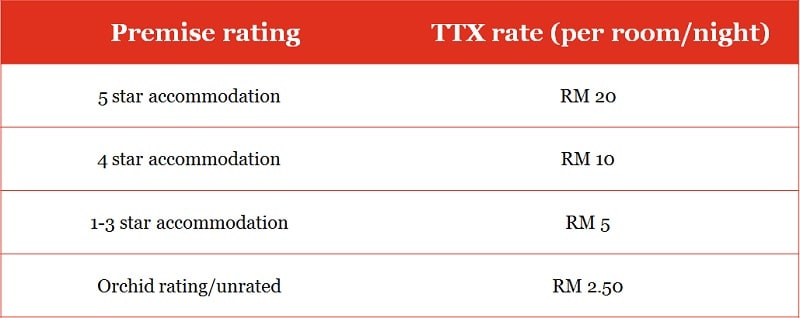

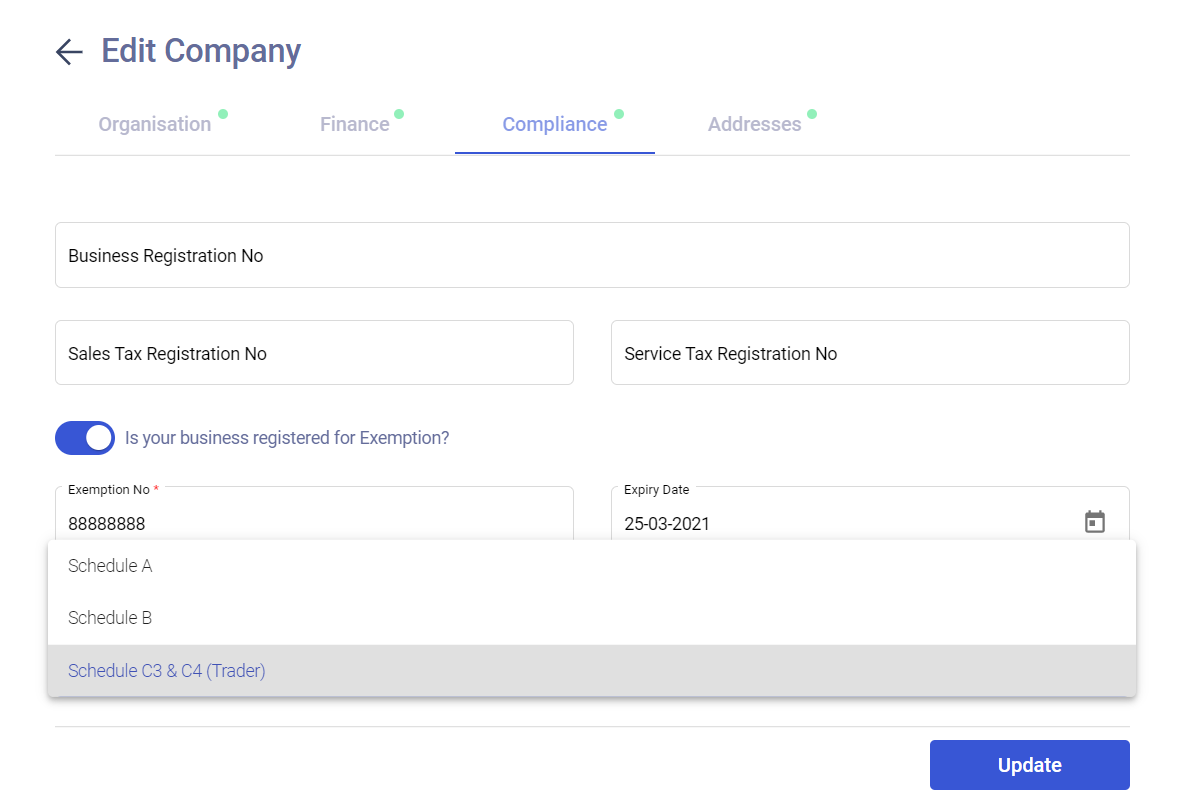

Malaysia Tax What Is Schedule A B And C All About

Pdf Goods And Services Tax Gst Transition To Sales And Services Tax Sst Impact On The Welfare Of B40 And M40 Households In Malaysia

Tax Invoice Goods Services Tax Abss Accounting Malaysia

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Malaysia Sst Sales And Service Tax A Complete Guide

Contoh Invoice Gst Malaysia Nintoh Otosection

Contoh Invoice Gst Malaysia Nintoh Otosection

What India Can Learn From Failure Of Malaysia S Gst Mint

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

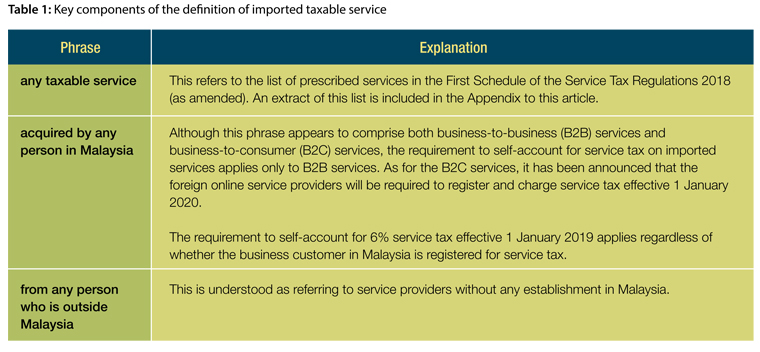

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today Malaysian Institute Of Accountants Mia

Malaysia Sst Sales And Service Tax A Complete Guide

Dianna Agron Looks Lovely In Louis Vuitton For Harper S Bazaar Malaysia

Notice Gst Zero Rated Effective On June 2018 Enagic Malaysia Sdn Bhd

Malaysia Sst Sales And Service Tax A Complete Guide

Pdf Goods And Services Tax Gst Transition To Sales And Services Tax Sst Impact On The Welfare Of B40 And M40 Households In Malaysia

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Contoh Invoice Gst Malaysia Nintoh Otosection